Your cart is currently empty!

Make the Bet…

|

The ChooseFI NewsletterToday, I’m going to talk about Financial Independence, which is why I want to share the ChooseFI Newsletter with you. My friend, Brad Barrett runs the largest Financial Independence community in the world where he simplifies personal finance and inspires you to take action to improve your:

More than 58k+ people read The ChooseFI Weekly newsletter for inspiration every Tuesday on their journey to financial independence. To improve your finances, read this newsletter! Today at a Glance:

LotteriesI first wrote about this in June when I read these two Sad Statistics:

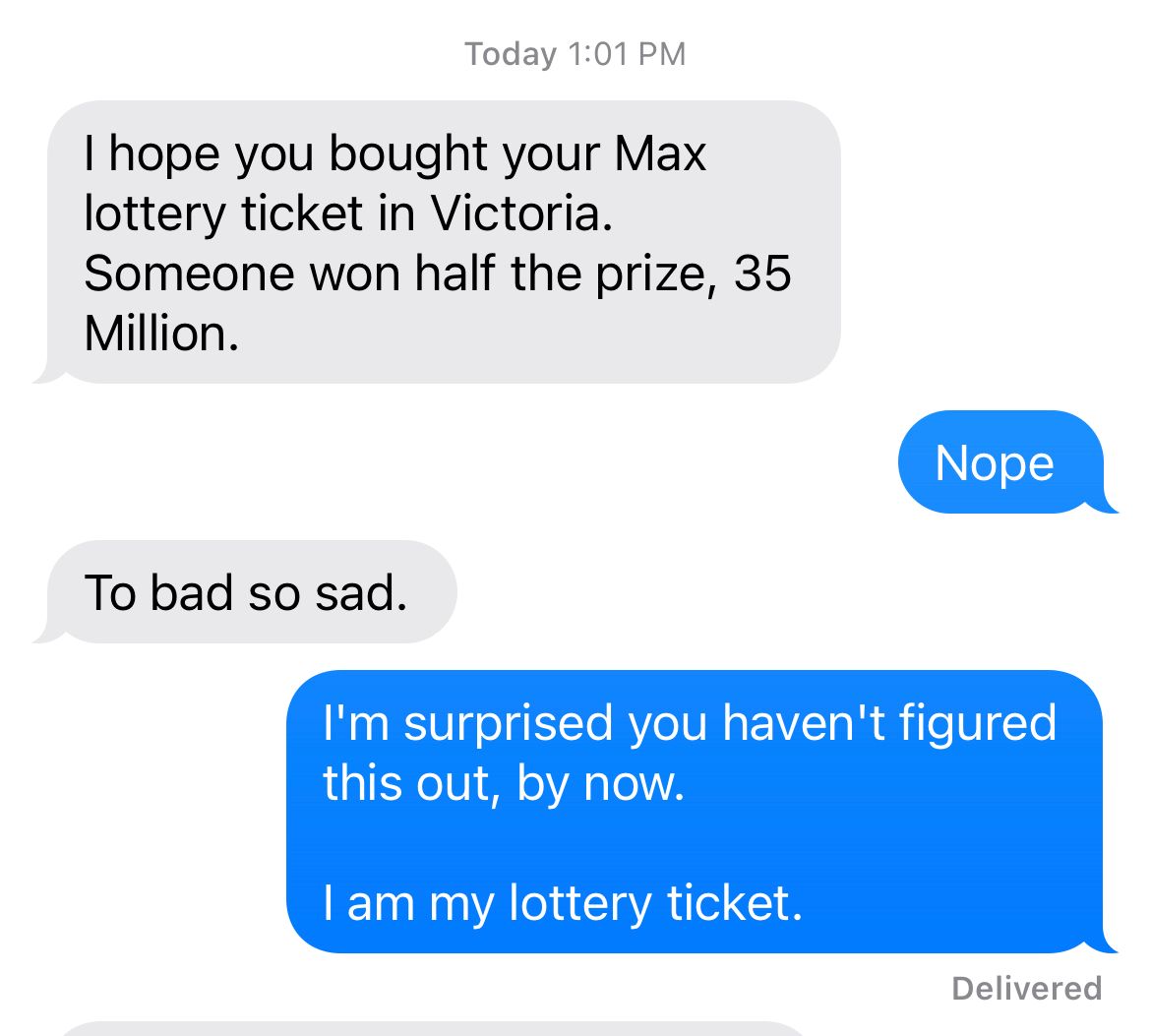

It struck me when I had this text exchange with my dad,

Okay, I may have given my father a flippant answer, but, there’s a reason for that. A lesson I’ve learned in life that flies in the face of the two statistics above is if we want to achieve Financial Independence, it’s on us. Nobody is coming to save you. Nobody is going to write you a million-dollar cheque. Even if they introduce Universal Basic Income, it won’t have the results people expect, because it will lead to a death spiral of inflation. You are the lottery ticket. You are how you’re going to become wealthy. The actions you take on a daily basis are what will lead to wealth. The downside of LotteriesI have a greater problem with lotteries. I come from a family like many of you. We didn’t have money growing up and nobody taught my parents or their parents about money and financial literacy. Without sufficient knowledge, my dad falls into the trap of so many people. He plays the lottery… It’s one of the reasons I write this newsletter. I don’t want you or my children to take that path in life. My dad isn’t alone, though, as those statistics indicate. Lotteries prey on vulnerable people. Those most likely to play the lottery regularly are typically:

Lotteries are a Regressive Tax which place a greater burden on low-income earners.

The Jet Renters and Lambo Loaners sell people:

The Bottom Line is there is no Get Rich Quick. Financial Literacy is about getting rich over time. FIRE MovementThis is where the Financial Independence Community comes in, which Brad and I are a part of. You see, finance is simple. It isn’t easy, but it’s really, really simple:

But, this is where the financial independence movement can sometimes get a bad rap. People can be too focused on the 2nd part of the equation or think that the entire FIRE movement is focused on it. For example, I read a post yesterday I disagreed with on financial independence, which was written by my friend, Justin Welsh:

As you can tell, 172 replies indicate there was some lively discussion on the topic. For those who aren’t aware, FIRE stands for Financial Independence and Retire Early, and a lot of people were introduced to it historically through Mr. Money Mustache who preached what’s now commonly referred to as LEAN FIRE, but that isn’t the only way. Here are different types of FIRE, what they mean and examples of the people living each type: Lean FIRE: This is living frugally to retire early. Expenses are kept very low. An example is Pete Adeney, known as Mr. Money Mustache. He retired at 30 by living minimally. Fat FIRE: Opposite of Lean FIRE. It involves a more traditional lifestyle in retirement, requiring a larger nest egg. An example is Grant Sabatier author of Financial Freedom. He achieved financial independence at 30 and advocated for a balance between frugality and enjoying life. Coast FIRE: This means having enough investments to retire at a traditional age without needing to save more. The focus is on a job you enjoy without worrying about high income. An example is Tanja Hester, author of Work Optional, who retired at 38 and focuses on a life aligned with her values. Barista FIRE: This involves quitting your main career but still working part-time, often in a low-stress job, for health insurance or extra income. Regular FIRE: This is the standard approach, aiming for financial independence to retire in your 50s or early 60s. Vicki Robin, co-author of Your Money or Your Life is a leading voice in this space. My view was Justin’s take was too narrow. It didn’t offer the perspective of someone like my friend Brad of ChooseFI who popularized FI for mainstream people in a way that’s decidedly not about pinching pennies and depriving. It’s about value and intentionality with freedom as the ultimate goal* *These are Brad’s words in reply to Justin’s Tweet. This brings me to a concept that’s been guiding my life – The FI and Pivot. FI and PivotA couple weeks ago, we talked about Burning the Boats versus the Spiderman Approach. For the past 5 years, I was living the Spiderman Approach, which started in January 2018 when I told my boss I was going to retire early and focus on the following:

Whenever I talked about it with one of my closest friends, it bothered him that I used the word Retirement, because it’s clear based on that list I was not going to retire. Instead, I was going to focus on what I wanted to do with my life for the rest of my life. Where we landed was the idea of FI and Pivot. I’m sure if we looked at it relative to the models above, we could slot it into either Coast FIRE or Barista FIRE, but it means more to me than that. The Pivot is intentional. It’s a Pivot to your life’s purpose. It’s a Pivot to what gives you meaning in life. What you want to wake up and do every single day. It’s increasing your net worth and your investments to the level where you can choose to do:

This is what I want for every person who read this newsletter. The ability to choose your path with intention. To mark a date in your calendar when you’ll be able to live the life you choose. When I first said those words to my boss in 2018, I said I’d give him 10 more years. But, every time I started to write Mission 2028, I always ended up with Mission 2025 on the page. It was the Universe Talking. When you look at the list of areas I said I was going to focus on, you’ll see that most of them have already been built. We got serious about the 10-year vision the Fall of 2020 and three years later we’d largely achieved it. In the next few weeks, I’ll lay out the date I intend to FI + Pivot and what the next steps on this journey will look like. If you were to FI + Pivot, what would you Pivot to – send me your answers, I’m interested to hear.

TGG PodcastThis week on the Growth Guide Podcast, we talked to Karolina Rzadkowolska about her book, Euphoric – Ditch Alcohol and Gain a Happier, More Confident You. This conversation was meaningful for me – in 2022, I quit drinking alcohol. It was the best decision I’ve ever made and my life improved in almost every measurable way. Here are 7 reasons you should consider Quitting Alcohol in 2024:

|

|

Update your email preferences or unsubscribe here |